NeoBank formation and strategy

Reinventing Banking

What makes fintech companies, also known as challenger banks, neobanks, or digital banks so attractive?

When you are building your neobank, it means your product has no physical branches. It offers access through a mobile app, and (or) online banking. Neobanks enable customers to manage their finances directly, order new products, and receive support 24/7 with just a few taps irrespective of where they are.

Neobanks – growing sector – Join now and launch you own fintech business!

As experience and customer satisfaction are gaining importance in the financial landscape, a gap has opened up between what traditional banks offer and what their customers expect from them. So, neobanks are willing to fill that niche in the market.

These digital entities owe their rapid growth and low costs to technology: since they do not have branches, maintenance costs are very low, which translates into lower commissions and more dynamic service for customers.

In addition, the fact that all transactions are made online means that neobanks can occupy a market niche unattended by traditional banks.

Build a neobank as a subsidiary of a tech company

Build your own Neobank and become a investor in the fintech market.

By partnering with Rinoinvest, our open banking solutions can provide your institution with the competitive edge needed to thrive while also ensuring top-notch security and compliance.

Benefit from our experience! We advise clients on Neo-Banks, Openbanks and Fintech Companies and develop their strategic plan and financial funding.

Do you need a sponsor? We also operate as a financial sponsor in certain projects. Talk to us!

Don’t miss out on the new investment opportunities in the banking sector!

Traditional banks that miss the digitalization will inevitably disappear. Some banks do not even have e-banking yet.

For example, let’s take a closer look at the well-known company Revolut: No fees when withdrawing money abroad up to a certain limit. Exact exchange rates without markup (unlike most banks that usually charge 1% to 5% on foreign currency transactions). User-friendly digital interface. No papers. No 100-pages agreement. Possibility of generating single-use virtual credit cards, which considerably strengthens the security of the online purchase process. And all this from your smartphone.

Foundation and Establishing

legal setup of your Neobank that start from scratch with all you need need to get a virtual bank license to conduct business.

Strategies and Deployment

We offer a Professional IT platform and efficient Marketing to ensure secure operations and customer satisfaction and high margins

Tax optimization

Holding company, location and partnerships. We optimize you results and adapt your fintech business to new legal environments.

Contact us today and learn more about our cutting-edge solutions designed to enter in the fintech sector with your own Neo-Bank!

Neobank Market Size Overview

Report says that the global market size of Neobanks has almost beaten the target of 35 billion U.S. dollars in 2020 and the estimated growth rate is 47.7 percent each year until 2028. It is projected to be 722.6 billion U.S. dollars.

The key growth driver is the extremely high penetration of smartphones around the globe which will grow further and double by the end of this decade. It boosts the competition forward as using smartphones pushes people to minimize physical presence in different places – banks, shopping malls and others. COVID-19 added more fuel to the popularity of remote services, but surprisingly – not neobanks.

As per Global Neobanks Report, at the beginning of 2020, the amount of Neobank users already exceeded 39 mln people around the globe. Analysis says that these are mostly iOS and Android (over 30 mln. downloads) users, that proves the point that Neobanks are mobile-first solutions.

The country that boasts the biggest amount of Neobanks is Great Britain. From the technology standpoint, their experience and practices of how to build a neobank are used by many other countries as a benchmark.

What Is Neobank and Its Workflow

There is a great difference between classical banks and neobanks. The latter ones aren’t chartered with state or federal regulators as banks, they almost never extend credit or overdraft users.

How do they make money?

The main source of revenue is banking interchange, which is actually the fees from merchants on the purchases in their stores paid by Neobank debit cards. Because of their smaller size compared to their megabank counterparts, Neobanks are allowed to interchange up to seven times bigger percentages than those available to traditional banks (having more than $10 billion in assets). Another way to make money for Neobanks is to charge customers when they are using out-of-network ATMs. Different Neobanks name different percentages, but basically, it is somewhat between 8% up to 20% of the overall income. For the reason of its growing popularity among younger people, Neobanks (also called challenger banks) are quite often funded by venture investors.

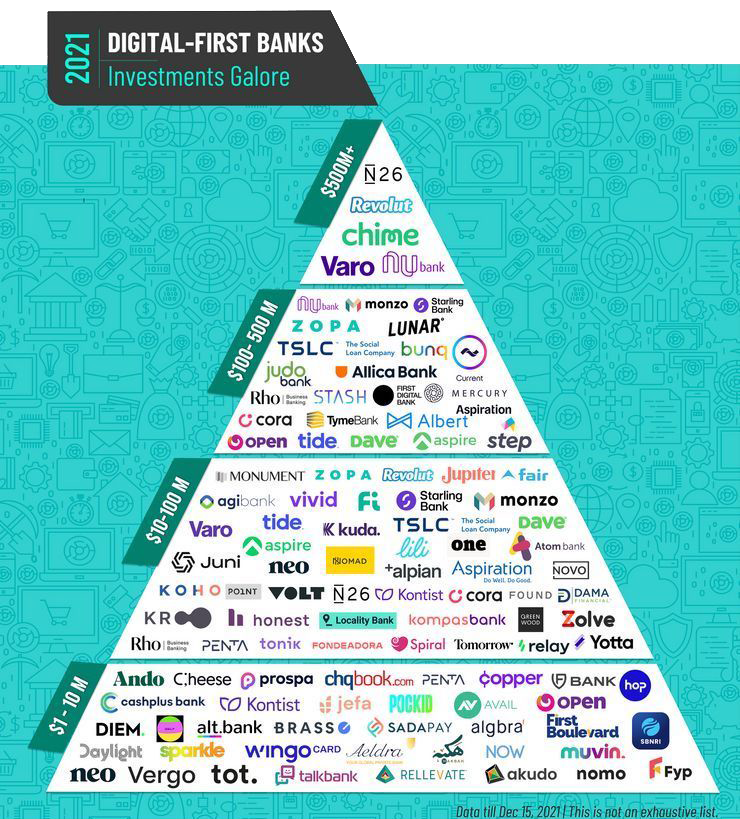

For example, in 2020 Chime bank got $485 million investments and Varo bank raised $63 million.

To launch your own Neobank you need to understand how a Neobank works. From the user’s standpoint, it’s a pro-level application that helps to effectively manage your money and supports you in taking decisions.

Our mission

Total Commitment to provide you a focused service. We establish, build and sustain on effective relationship with an individual client to give meticulous attention to the minute details of our business as we believe that Client Satisfaction is the ultimate victory for any successful business group.

Our vision

Our expert consultants are always coupled with a drive to understand each client’s unique needs & goals. Rinoinvest is continuously upgraded to meet demands of a growing & sophisticated business environment

Value for money

When you choose us, you’re choosing peace of mind during and beyond your Fintech-Project. Whether it’s simply setting up a Neobank company or if you’re looking for the full service of foundation, strategy and tax optimization for your Neobank, we offer complete value for money.

Customer Focus

We provide the exact same level of focus and thoughtfulness while consistently delivering high-quality service expected from professional consultants. Whether you are a major international investor or a small individual investor, we will provide you with the same service level.

No Hidden Cost

Global Outreach

Starting your Neobank can be bewildering. However, Rinoinvest consultants have served clients from all corners of the world. They are experts in supporting an assortment of founders’ needs for various global enterprises.

Reliable and Trustworthy

Infused with the core principles of productivity, innovation, transparency, trust, respect, and responsibility for one’s actions, we are proud to say that our company is based on building relationships by delivering on our clients’ expectations.

Team Rinoinvest takes your Neobank Project further and holds your hand in every step of your growth, which has helped us achieve an unshakable position in the market today.